Mongolia and China have formalized plans to construct a new cross-border railway, aiming to significantly boost coal exports and streamline trade logistics. The agreement, signed during Mongolian Prime Minister L.Oyun-Erdene’s visit to Harbin on February 14, underscores Mongolia’s push to expand its coal exports to China while carefully managing its economic reliance on its southern neighbor.

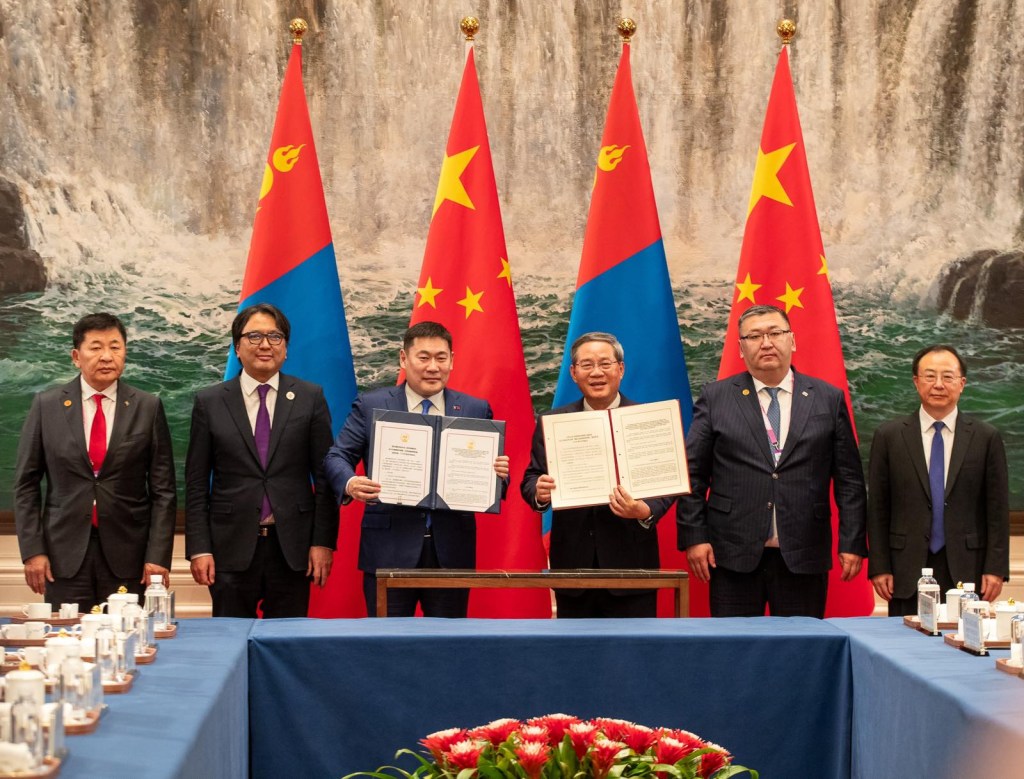

The “Intergovernmental Agreement on the Gashuunsukhait-Gantsmod Cross-Border Railway, Coal Trade, and the Expansion of Tavan Tolgoi Coal Mine Capacity” was signed in the presence of high-ranking Mongolian officials, including Deputy Prime Minister T.Dorjkhand and Ministers of Transport, Mining, and Energy. The project, part of Mongolia’s 14 mega projects, marks a major step in addressing long-standing logistical bottlenecks that have constrained coal exports.

The Gashuunsukhait-Gantsmod railway is Mongolia’s second direct rail link with China, following the Zamiin-Uud-Erlian railway established in 1955. Once operational, it is expected to:

- Double border capacity, increasing coal exports from 83 million to 165 million tons annually.

- Boost Mongolia’s coal export revenue by an estimated $1.5 billion per year.

- Lay the groundwork for future railway expansions, including Shiveekhuren-Sekhee, Bichigt-Zuunkhatavch, and Khangi-Mandal routes.

Construction Timeline and Infrastructure Challenges

Construction is scheduled to begin in April 2025, with completion expected within 2.5 to 3 years. The estimated cost stands at 974 billion MNT (283 million USD). However, infrastructure misalignment remains an obstacle: while China’s existing narrow-gauge railway extends to within 300 meters of the border, Mongolia’s railway stops 10 kilometers short. This means Mongolia must construct 10.3 km of new railway to complete the connection.

A 16-Year Coal Agreement: Economic Windfall or Strategic Risk?

Beyond infrastructure, Mongolia and China have also agreed to a 16-year coal purchase deal with the following volumes:

- 5 million tons in 2025;

- 6 million tons per year in 2026 and 2027;

- 20 million tons per year from 2028 onwards.

While the long-term contract provides stability, key economic risks remain:

- Pricing Mechanism: If Mongolia agrees to a fixed price below market rates, long-term revenue losses are likely. Tying prices to international benchmarks or using a floating model would mitigate this risk.

- Buyer Dependence: China is Mongolia’s dominant coal buyer, limiting Ulaanbaatar’s leverage in negotiations. Ensuring transparency in contract terms will be critical to avoid agreements that disproportionately benefit China.

- Fiscal Pressures: The Mongolian government is banking on coal revenues for its 2025 budget. Any delays in railway construction or unexpected market downturns could result in major fiscal shortfalls.

The agreement now awaits parliamentary approval when Mongolia’s spring legislative session opens on March 15. Once ratified, company-level agreements between Mongolian and Chinese firms can proceed, finalizing project financing and operational details.

The Bigger Picture

The Gashuunsukhait-Gantsmod railway will undoubtedly strengthen Mongolia’s coal export capacity, reduce transportation costs, and improve trade efficiency. However, the project also highlights broader challenges in Mongolia’s economic strategy—balancing its growing dependence on China with the need for long-term financial sustainability. As the country increases its trade with China and expands border railway port connections, ensuring transparency, fair pricing, and strategic diversification will be critical to securing Mongolia’s economic future.

Leave a comment